Surviving on a budget

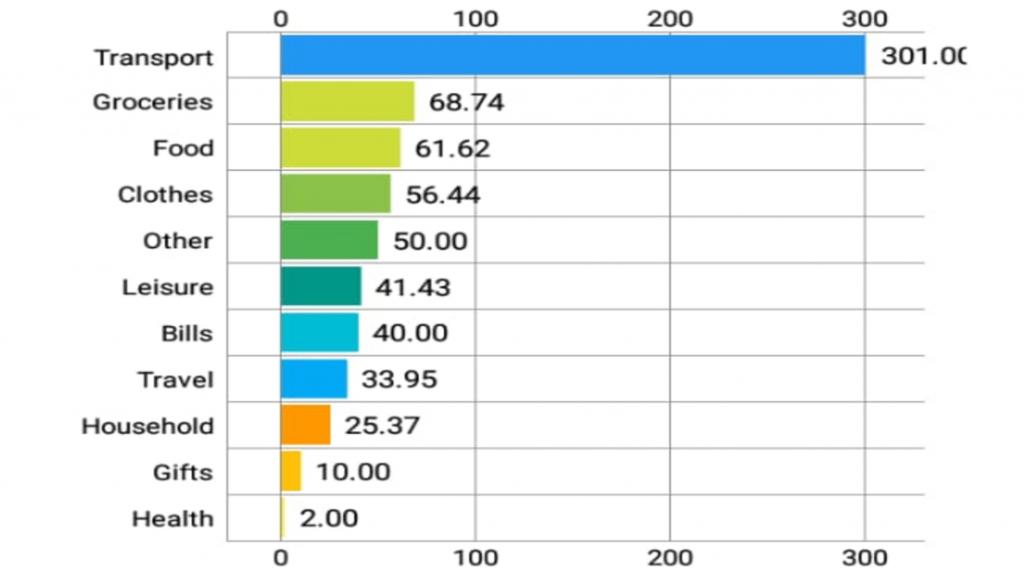

One of the biggest surprises for me at Loughborough was that the monthly expenses here could average to approximately £300, if budgeted well.

Since I am an international student, I had a lot more arrangements needed from my end with regards to my winter wear, bedding sets, kitchen utilities, etc.

In the beginning and thankfully upon my family’s insistence, I had brought most of my stationery, books and some basic kitchen related products that are needed with me, since they are reasonably priced in India. On the other hand, there were many products that I had to purchase on my arrival in the U.K.

While I was rattled, like many new students are, at managing everything – and having to focus on the finances was adding to the stress – I was sort of prepared for this challenge, courtesy of my inherent money-handling skills (the one trait my parents are proud of, sorry mum and dad!!) and the University’s link on expenses, and few student blogs.

Here, I will share how I managed to live on a budget of £20 for a week.

This is inclusive of all my groceries as well as treating myself at BomBom Patisserie (a café behind the university), Peters (a pizzeria in town) or Oh Deer (stationery store in the town). My groceries were inclusive of the basics – milk, fruits, vegetables, proteins and my leisure item – a tub of ice-cream; lastly, my share of the household items.

Plan

One of the first things I learnt to do was plan an expected budget for the week. Before moving, I already had a vague idea of how much it could cost me a week, month and the year. Also, while planning the week’s schedule, one should make a rough understanding of what the expenses for the upcoming week and can even decide on the meals (during extreme crunches, I plan the menu based on the items on discount), which helps in purchasing groceries and avoids wastage.

For this purpose, I initially maintained a diary and coordinated with my parents who maintained an excel spreadsheet, but soon I gave in to relying on apps designed for budgeting, like ‘Expense Tracker’. Such apps display my income and expenses and categorises my expenses with enough supporting and simplified charts. This helps me plan how much and where I need to spend and cut down on (prioritise!) and is also easy for my parents to comprehend.

Prioritise

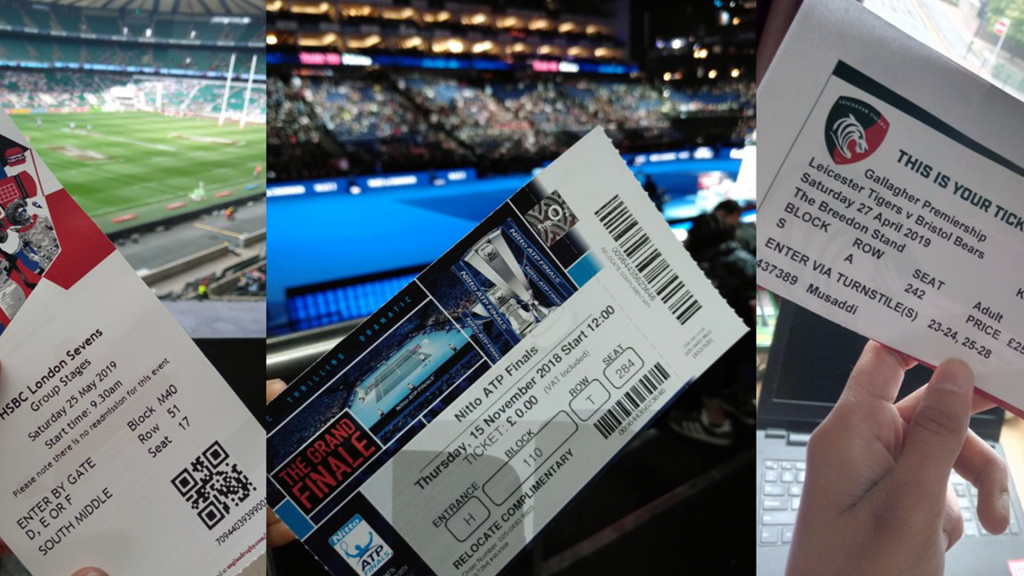

Differentiating between what is needed, and what is luxurious was another step in saving my money. Personally, this is the toughest step in managing finances since I wanted to make the most of my Loughborough and Masters Experience by travelling, watching games, and meeting and interacting with various people.

Having these forms of ‘leisurely activities’ is crucial and reinforcing, and to make it possible, I keep a huge amount of my income (by doing part-time jobs like Student Ambassador) for it, and would plan my budget and save money from other areas:

- Cooking v/s Eating Out: One of the highlights of living in the town is I have easy access to many more restaurants and cafés, and some are quite reasonable. But a standard trip could easily cost around £7. Therefore, to save money, it is always suggested to cook more often and avoid the wastage of food at home.

- Socials: one thing that comes usually with student life are the exciting, rewarding and the much-needed socials (and night life). However, one night-out could easily cost around £20 (a drink at a good place costs around 5 and food might be ranging from 5-10). One strategy that has worked well with my friends are carrying only the specific amount in cash on socials/night-outs and being conscious about their spending, so that there’s no scope to get tempted.

On the other hand, during the end of terms – with every society, club, department organising a social that could go on for 2 weeks, I save my money by drinking/eating only at select/alternate events (as this, I felt, was good for my health and helps me save a big sum).

- Snacks: While socials were the reason for my large expenses, I noticed my habit of snacking was being very heavy on my pockets and health. Therefore, to avoid unhealthy snacking, I started using a lot of my fruits, and avoided purchasing crisps, etc., and only bought things that were of ‘value for money’ to me – like a box of microwavable popcorn (a pound at ‘Poundland’), a box of grapes (from the market place, which costed me a mere pound), etc.

Purchase Smart

Since Loughborough town centre has several stores, my friends and I plan on what we should buy and from where, and try to shop together, this helps us in purchasing things in bulk and share items (which costs lesser).

For instance, ‘Savers’ and ‘Dunelm’ has some really good deals on household products, ‘Poundland’ is good for snacks and deals on cookies, ‘Iceland’ has a discounts always on some frozen food, and fruits, vegetables and poultry are fresh and relatively cheap at the market place, and others.

Also, there are numerous departmental stores in Loughborough which have their discounted section and even provide additional coupons and vouchers if one’s a member.

When it comes to shopping, every store has a discount section and some brands even have a ‘sale season’, which stops me from thrift-shopping all the time and also makes shopping clothes, accessories and gifts affordable. Moreover, since I have a massive fondness for stationery, I try to reserve this for my trips to other parts of the country and buy myself few treats.

I also have had an added advantage of receiving posts from home, which includes almost all my favourites, from highlighters & pens, t-shirts & tops, to pickles, snacks and cakes. These boxes of surprise are very comforting and also help me go easy on my pocket.

Finally, I also ensured that I bought all my passes/cards (for train, National Express, KinchBus – local bus service/s, Oyster, etc), which could allow me to travel within Loughborough and around the country at a much reduced price.

Managing a budget could be task, but the good thing is there’s no wrong way of doing it. And yes, one should always take out some money and time to do things they enjoy doing – shopping, watching movies, going out with friends, etc; it’s important to save your money for what is needed, without compromising on your health.

Student Life

Find out what makes 'The Loughborough Experience' by reading our student blogs.